Arrived Homes Review (2025): Fractional Real Estate Investing Made Easy?

TL;DR:

- Arrived Homes is a "real estate investment platform" that allows individuals to buy shares in single-family rental properties and vacation rentals with a low minimum investment (often $100).

- It offers a path to "passive income real estate" through quarterly rental dividends and potential long-term property appreciation, with Arrived managing all operational aspects.

- While providing accessibility and diversification, investors should understand the fee structure and the illiquid nature of these long-term investments.

Investing in real estate has long been a popular path to building wealth, but the high barrier to entry and ails of property management have kept many on the sidelines. Arrived Homes aims to change that. This "real estate investment platform" offers fractional ownership in rental properties, allowing individuals to "invest in rental properties online" with as little as $100. This "arrived homes review" will delve into how the platform works, the types of returns investors can expect, the associated fees and risks, and whether Arrived Homes truly makes real estate investing effortless and accessible for everyone in 2025. Is this the future of "passive income real estate" or are there hidden complexities?

How Arrived Homes Works: The Fractional Investing Model

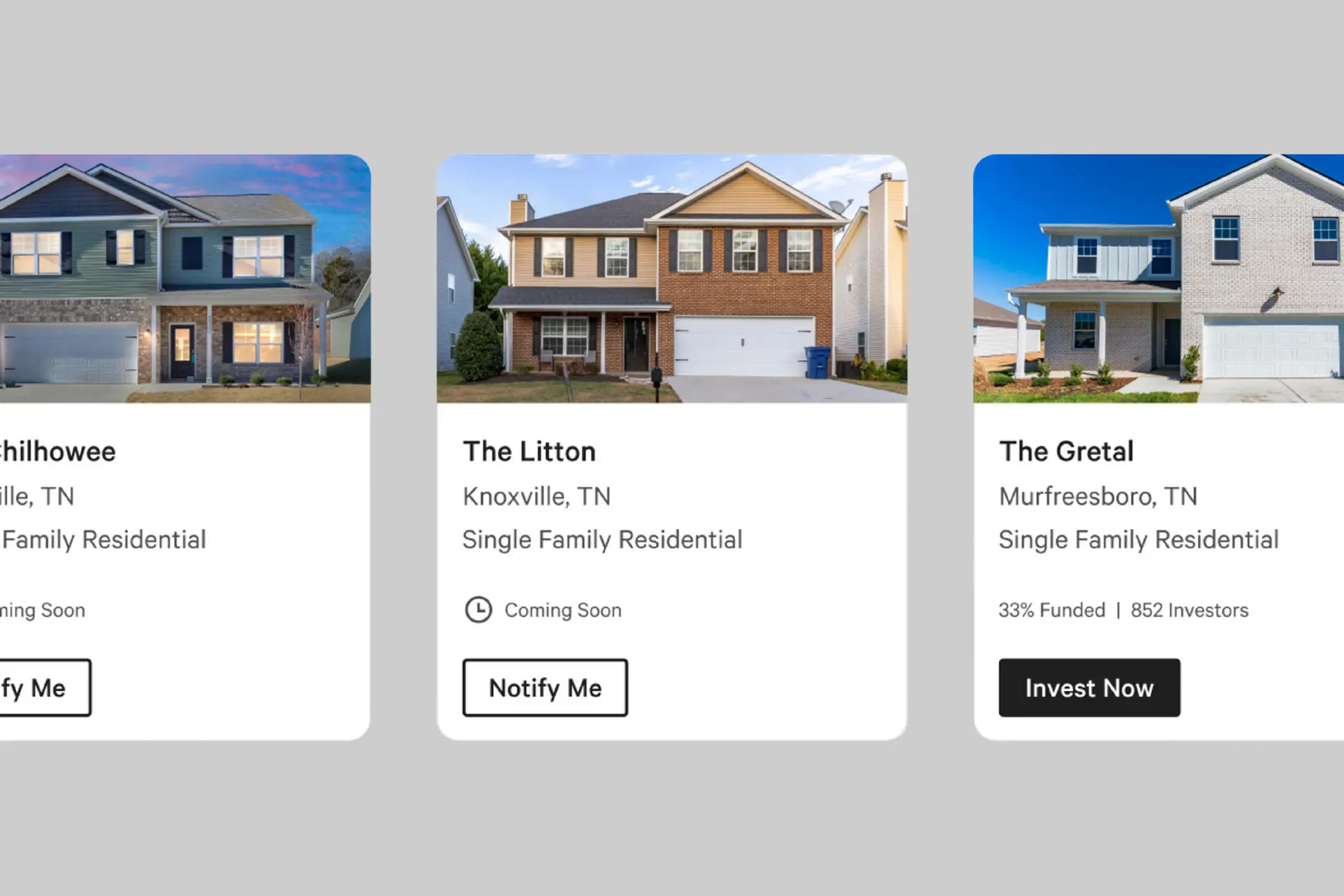

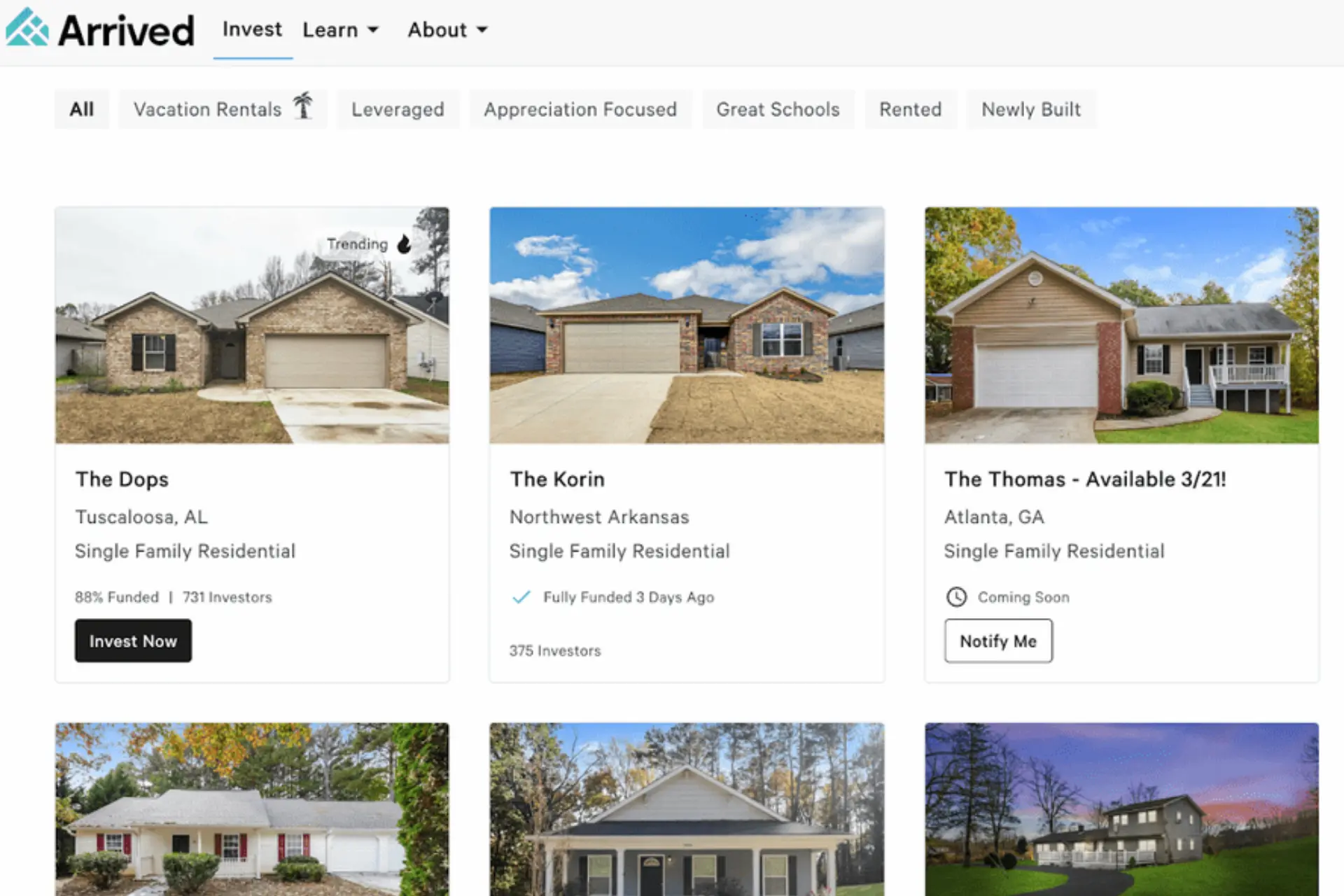

Arrived Homes simplifies real estate investing by breaking down ownership into shares. The company identifies and purchases residential rental properties (both long-term rentals and, more recently, vacation rentals), then offers shares of these properties to investors through its SEC-qualified platform. Investors can browse available properties, review due diligence materials (including financial projections, inspection reports, and market analysis), and decide how much they want to invest in each, starting from a "low minimum real estate investment" threshold. Once invested, Arrived Homes handles everything else: finding and managing tenants, collecting rent, overseeing property maintenance and repairs, and handling all administrative tasks. This model provides a truly passive experience for the investor.

Generating Returns: Rental Income and Appreciation

Investors on the Arrived Homes platform can potentially earn returns in two primary ways:

- Rental Income: Net rental income (after operating expenses, property taxes, insurance, and Arrived Homes' fees) is typically distributed to investors on a quarterly basis in the form of dividends. The amount can vary based on occupancy rates and operating costs.

- Property Appreciation: Over the long term (typically a 5-7 year holding period, though this can vary), the value of the underlying property may increase. When a property is eventually sold, investors receive their pro-rata share of any net appreciation.

Diving Deeper: Property Selection, Fees, and Liquidity

Understanding the nuts and bolts of the platform is crucial before investing.

Property Curation and Due Diligence

Arrived Homes employs a data-driven approach to select properties in markets they believe have strong potential for rental income and appreciation. They conduct thorough due diligence on each property before acquiring it and making it available for investment. Investors have access to detailed information about each property, including photos, location details, financial models, and risk factors, allowing them to make informed decisions. The types of properties range from single-family homes in suburban neighborhoods to, more recently, vacation rental properties in popular tourist destinations.

Understanding the Fee Structure

Transparency in fees is critical for any investment platform. Arrived Homes typically has a few layers of fees. These may include an initial sourcing fee (to cover the costs of acquiring and preparing the property, often baked into the share price), an ongoing asset management fee (a percentage of the property's value or rental income, charged quarterly to cover platform operations), and property-level operating expenses (which are deducted before dividends are paid). It's essential for investors to understand all associated costs to accurately assess potential net returns. The "Arrived Homes pros and cons" often hinge on how these fees impact overall profitability.

Liquidity and Holding Periods

Investments in fractional real estate through platforms like Arrived Homes are generally considered illiquid. This means you typically cannot easily or quickly sell your shares for cash. Arrived Homes usually outlines an anticipated holding period for each property (e.g., 5 to 7 years), after which they aim to sell the property and distribute the proceeds. While they have explored or may implement limited secondary market or redemption options, investors should be prepared to hold their shares for the full term. This long-term nature is a key characteristic of "fractional real estate investing."

Pros and Cons of Investing with Arrived Homes

Here's a balanced look at the advantages and potential drawbacks:

- Pro: Low minimum investment (often $100) makes real estate accessible to almost everyone.

- Pro: Truly passive investment – Arrived Homes handles all property management.

- Pro: Potential for regular passive income through rental dividends.

- Pro: Opportunity for long-term capital appreciation.

- Pro: Easy diversification across multiple properties and geographic markets.

- Pro: SEC-qualified offerings provide a degree of regulatory oversight.

- Pro: Transparent property information and due diligence materials available.

- Con: Investments are generally illiquid with long holding periods.

- Con: Various fees can impact overall returns (sourcing, asset management, property operating costs).

- Con: Rental income and property appreciation are not guaranteed and subject to market risks.

- Con: Limited control over property decisions compared to direct ownership.

- Con: Tax implications can be more complex than traditional stock investments (investors often receive a K-1).

Who is Arrived Homes Best For?

Arrived Homes is an excellent platform for individuals who want to add real estate to their investment portfolio without the significant capital outlay or ails of being a landlord. It's particularly well-suited for:

- Beginner Investors: The low minimum and educational resources make it a great entry point.

- Passive Income Seekers: Those looking for potential quarterly cash flow from rental dividends.

- Diversification Enthusiasts: Investors wanting to spread their risk across different properties and markets.

- Busy Professionals: Individuals who lack the time or desire to manage rental properties themselves.

Final Verdict: Is Arrived Homes a Smart Way to Build Real Estate Wealth in 2025?

Arrived Homes has successfully democratized access to residential real estate investing, offering a user-friendly platform for "fractional real estate investing." Its low minimums, passive income potential, and professional property management make it an attractive option for a wide range of investors in 2025. While the illiquidity and fee structure are important considerations, the platform's transparency and the potential for long-term wealth creation are compelling. For those looking to dip their toes into real estate or diversify their existing portfolio with a hands-off approach, this "arrived homes review" finds that Arrived Homes provides a legitimate and innovative path towards achieving "passive income real estate" goals. It has certainly made investing in rental properties more accessible than ever before.